ECOMMERCE

Seamless Payment Solutions for Your Business.

Empower Your Business with Our Payment Solutions.

Tally Processing’s Guide to Payment Acceptance in E-Commerce: Credit Card Processing

Ultimate Guide to Payment Acceptance in E-Commerce: Credit Card Processing

To thrive in e-commerce, it’s imperative to embrace credit card payments

but one should also consider the inclusion of digital wallets such as Apple Pay and Google Pay, along with buy-now-pay-later (BNPL) options, digital invoicing, and recurring payments like in-app subscriptions. The top-tier credit card processing services excel in accommodating diverse online transaction methods and effortlessly integrating with a range of e-commerce platforms.

Nonetheless, it’s important to be aware that e-commerce credit card processing firms might include concealed charges or cumbersome checkout interfaces.

Either of these factors could have an adverse effect on your profit margins or sales volume. It’s crucial to gain an understanding of the mechanics of online payment processing, the transaction fees that will be incurred, and how to effectively evaluate different merchant account providers for your online store.

Comprehending the Services of Payment

Processing in E-commerce

Following a customer’s addition of an item to their shopping cart, they proceed to examine payment choices and complete the purchase.

What appears quick online actually entails numerous behind-the-scenes procedures. E-commerce platforms facilitate electronic payments through shopping cart integration, which serves as the customer interface. Payment gateways secure the data and transmit it to your credit card processor.

From there, your payment processor connects with credit card networks, which request authorization from the cardholder’s bank account. The information circles back through your credit card processing service and payment gateway, informing customers of a transaction’s approval or denial.

With a traditional merchant account provider, you may have to submit batch requests to your credit card processor with all credit card transactions at the end of the day. But e-commerce platforms often handle this aspect automatically. Best of all, you can view sales volume and online payments via your mobile processing app or online portal.

How to Make Online Sales and Virtual Payment Acceptance

Incorporating credit card payments into your e-commerce operations can facilitate the growth of your business. As indicated by Comscore’s State of Digital Commerce report, online retail sales in the United States crossed the “$1 trillion mark in consumer spending for the first time,” marking a 21% year-over-year (YoY) increase. However, the competitive landscape is intense, and the checkout experience for customers holds significant importance. Opting for the appropriate payment service providers and payment gateways not only guarantees security but also delivers a seamless online payment experience.

To enable credit card payments, you should take into account the following considerations:

Pricing and Charges for Online Credit Card Payments

Prominent payment processors are obliged to remit transaction fees to credit card payment networks and issuing banks to account for interchange rates.

In addition to this, they include an additional margin to cover their operational costs. Usually, the processing fee for a debit card is lower than that of a credit card. Nevertheless, these rates can differ based on the payment method, pricing model, and various other variables.

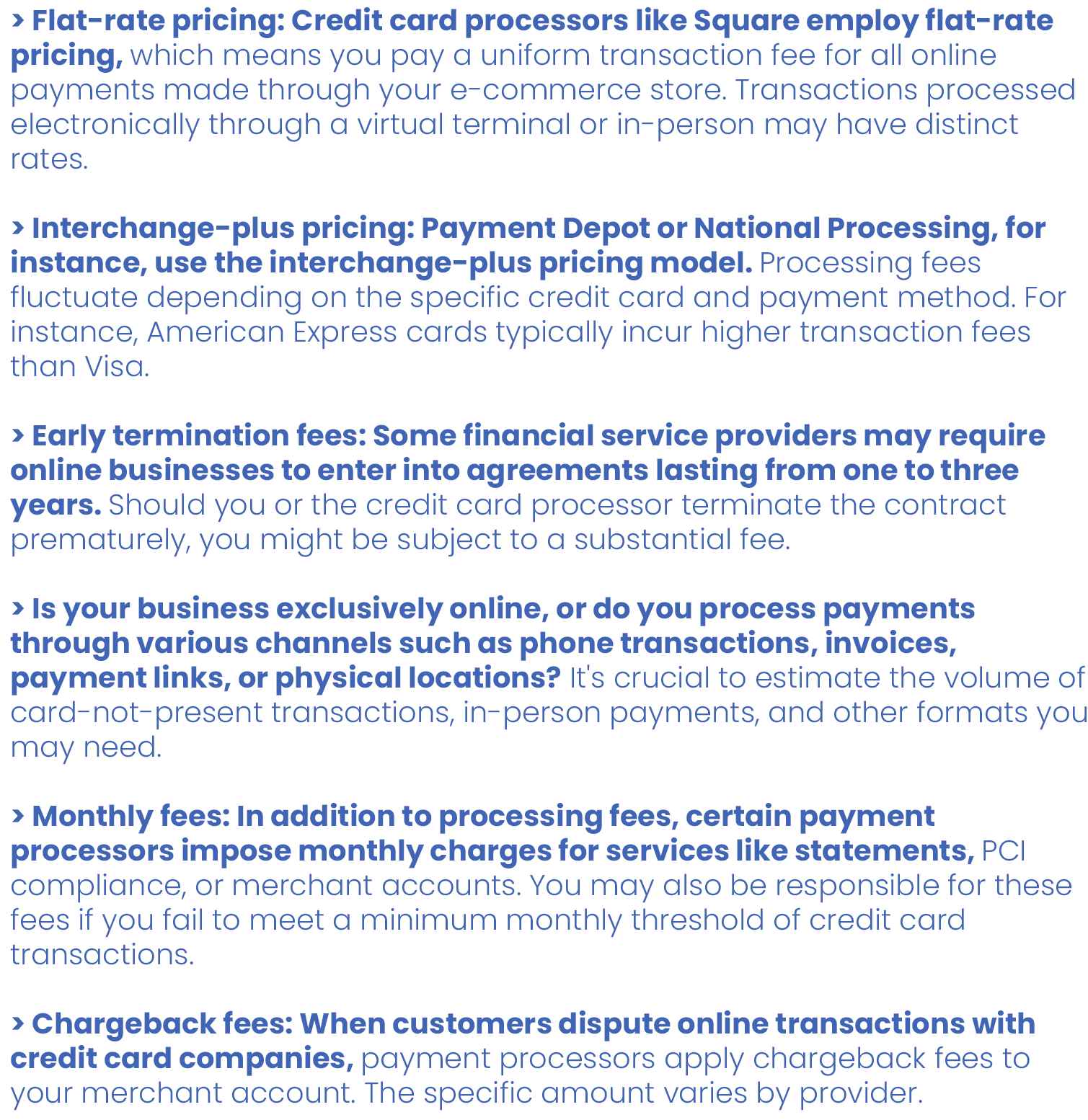

Below are a few charges you might incur when enabling credit card payments on your online store:

CONTACT US

Our support team is available 24/7

GET STARTED

What are you looking for today?